The Journey to FIRE and Putting it all Together

I've always been frugal and saving and delayed gratification has come naturally. My Dad always told me that if I saved 10% of my income and invested it I'd be a millionaire by the time I hit 40. Likely one of my biggest financial mistakes was just believing that blindly without doing the math. The reality is you need to save much more than 10 % or perhaps have the 10-15% interest rates of the 1980s when he told me that.

So based on that, I set up automatic withdrawals to my RRSPs of roughly 10% and figured I was set. If I want to dwell on the missed opportunity part we could have easily saved more in various investment accounts and made massive returns during the 2008 downturn. I started working in 2003 and as long as I'd been able to stay steadfast and not panic, while focusing on investments we could potentially have been much farther ahead. Being debt adverse our main strategy was paying down the mortgage and a little bit of real estate. So definitely not terrible overall and if using the methods people in the FIRE community use to calculate saving rates we have always been much higher than 10%. I just didn't realize it at the time.

To give a bit of history of how our net worth has progressed and what we did, we bought our first condo in 2003, spent less than $5000 doing some cosmetic fixes and sold it 3 years later for a profit of $60 000. In 2006 we bought our 2nd condo, a bit bigger and lived there for 3 years and paid down the mortgage aggressively for a bit, then when PapaBird got a job about an hour and 15 minutes away we started saving up for a down payment on a house and planned to keep this condo as a rental.

We were very fortunate in finding good tenants and we continued to rent it out for 6 years and decided to sell it in 2015 when our 2nd set of tenants told us they were leaving and it was a year out from our planned move to Edmonton. I really wanted to keep it long term as it would have been a great apartment for kids wanting to go to school in Montreal, but fear and my limited google results not turning up a property management company that would be interested in our single unit lead us to sell. We were still very fortunate as the real estate market in Montreal was hot and the value increased by about $100 000 in the 9 years we owned.

During this time we saved about 10-15% in our RRSPs, basically whatever gave us the best tax return ratio and left over was used to pay off the mortgage or went to paying off renovations on our house.

So we were off to a good start, but in my head I thought we were doing excellent and we'd have our million by 40, well because my Dad said so. I hadn't given much thought to retiring early. The only thing I really considered was quitting to be a stay at home mom. I didn't love my job and I was exhausted by the commute, frustrated by the lack of work and being pushed to part time due to lack of work at the consulting firm, but staying on because it was easiest. I was hoping to have a third baby so was sticking around for the maternity leave (we get 12 months paid leave from the government based on our salaries) and if the didn't pan out hoping I might be able to get a transfer to the Edmonton office when my company had its headquarters. (Spoiler that didn't work out because my area of work is based out of Calgary). It now also didn't make much sense to try to switch jobs given we were moving cross-country in less than a year. The main reason I couldn't bring myself to quit was fear of losing my career entirely. It is very technology based and I'm not sure how easy it would be to get back into it should I need to at some point. And also if I'm honest, being a stay at home mom with small kids scares me. I fear I would quickly become quite depressed with the isolation and my happiness would depend on making a good social network, which is not the easiest thing to do.

In 2015 I discovered Mr. Money Mustashe and all the peices fell together. We were almost there! I didn't need to quit alone and risk being lonely and depressed. We could do it together! We could hit FI in a couple years if we slashed the budget a bit more, stayed in our house and learned to DIY more things. I was so excited. It felt so close. We could quit work and travel the world, go on amazing adventures, home school the kids... I was in mega dream mode! PapaBird was not. What's the point? He would ask? Why would I want to quit work and continue to live in a little house I find too small? I like working. More things he'd respond to me while in dream mode. He could not understand why I wanted to cut things, I wondered why he couldn't get on board with this new found goal of freedom that was just within our grasp, ok 4-8 years out depending on the simulations I'd run. Less if we got really crazy and moved into a tiny home LOL.

My light bulb moment came when I realized this is a journey and it's all about finding your best life and trimming the excess that brings no joy. Identifying how we can find this for the lowest cost and then saving the rest. That gap between what life costs and what you make is where the freedom comes from. Your financial independence. (Note, to read more about the power of this gap see this post ) The journey to FIRE, while shorter than most to traditional retirement, is still years, five to 10 in most cases, so we have to make sure we are living our best life. The journey to FI IS our life, not just a period of sacrifice till we hit the destination. Especially for people like us, in our mid-30s with kids. This stage of life, albeit hard and exhausting at times, is also very precious. If we have the option to work a bit less and have more time with our kids that is worth so much more than reaching the FI number a few years earlier. We will also enjoy the journey and our family life more because we aren't exhausted from working 60 hour weeks while trying to raise 3 kids. We might actually have a bit more patience for each other and continue to nurture and love our relationship as a couple.

Also when you've figured out what your best life costs and are able to save the rest, you'll never feel like you are sacrificing to get there. You are just living your best life and then after the set number of years based on the percentage you're saving (and investing) will have magically reached FI. The beauty though is, each milestone hit, each increase of 20 50, 100 thousand gives you a bit more freedom, more options to change as life might dictate.

This is still definitely a work in progress for me and the allure FIRE is a stronger draw for me than PapaBird, but we have figured out where to compromise for each other. For me it was agreeing to a larger house which has been PapaBird's life long goal. I do benefit from the house and like it, but could be just as happy in a smaller house. The house does likely mean a few more years till true FI, but that's ok. It was that important for PapaBird. I can accept that we are not as hardcore Mustachian as I might like to be and he compromises in other areas that make it work for us. It is still a challenge and work in progress to figure out what is our best life, but I feel we are pretty darn close and that is pretty amazing. Not being stressed about money is such a privilege and luxury that I am so grateful to our younger selves for. We could have done better with more knowledge, but we've done pretty darn good. FI here we come! Just not sure how many years that may be now, but I'm ok with that. It's a journey so we're going to enjoy it.

|

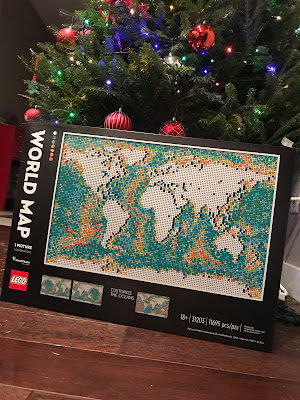

| Our journey to FI includes vacations! |

Comments

Post a Comment